Transform Credit Decisions with AI Technologies

Automate and enhance credit decisions by applying machine learning

REQUEST A DEMOProblem:

3 out of 4 small businesses, from online sellers to mom and pop shops, can’t get the financing they need to grow, or even sustain their business. Not because they lack creditworthiness. But because lenders are unable to assess their risk. Lenders today still rely on a method that was invented and used in the ‘60s.

Problem with today’s credit underwriting

Solution:

How it works

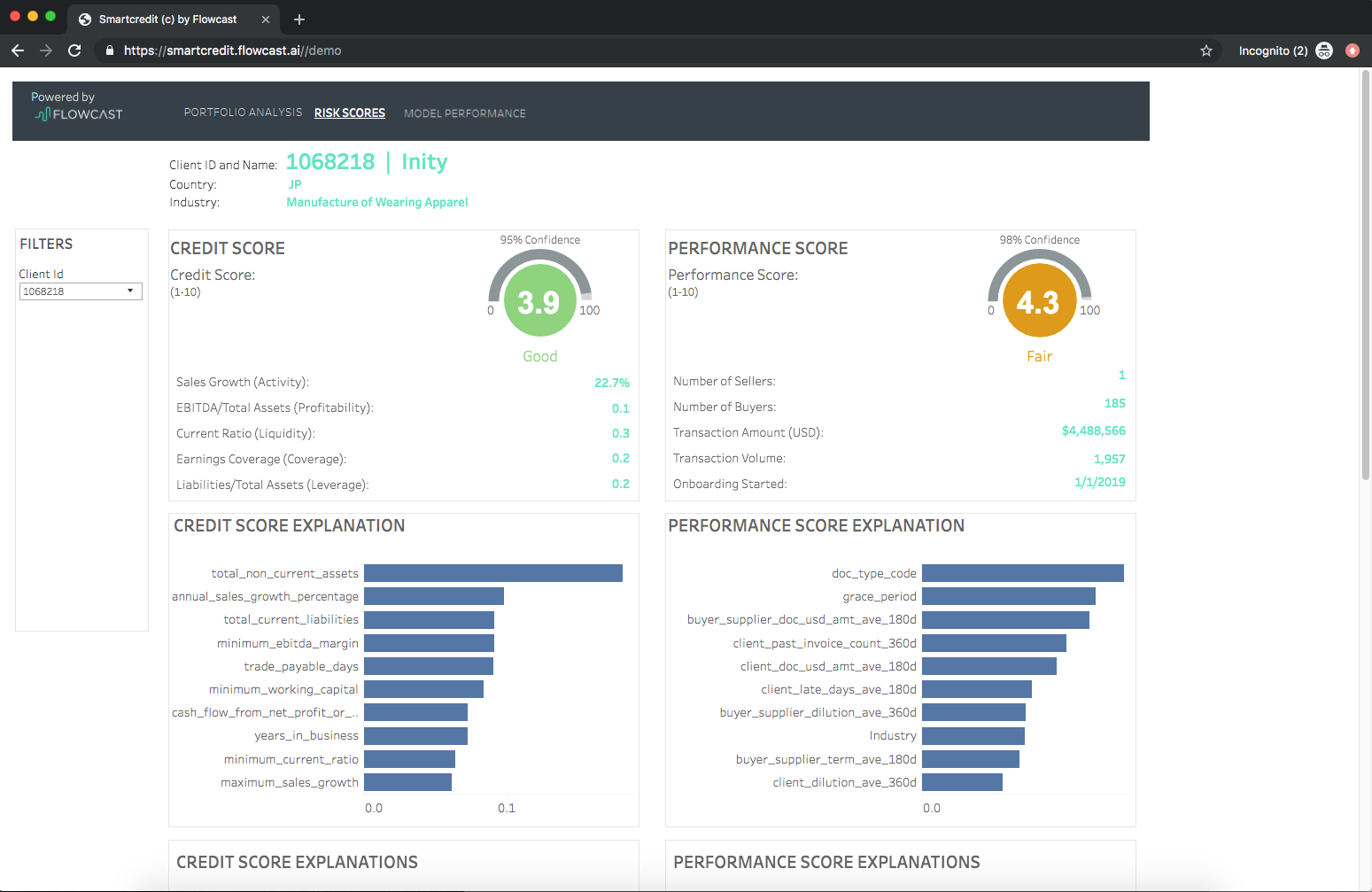

Accurate Predictive Models

Flowcast’s AI-powered credit decision solution draws on diverse data types, with more up-to-date and detailed company data to assist with decisions on thin-file, credit-invisible SMEs.

Aggregate Different Dataset

By incorporating a broader set of available and emerging data sources, Flowcast’s proprietary machine learning algorithms make it possible to leverage company information previously uncaptured by the more traditional credit scoring models.

Seamless Workflow Integration

Each dispute is scored to determine validity with confidence levels.

Scores are easily integrated with dispute workflow via API.

Actionable Insights

Advanced analytics is provided to support model perfomance and root cause analysis results.

Benefits:

Increase lending capacity

With significantly greater accuracy in assessing risk, lenders can onboard new borrowers whose risk they couldn’t previously assess. Further, lenders can actively monitor existing client credit profiles in real time, allowing for dynamic credit limit adjustment.

Process applicants faster

Through automation, lenders can speed up the underwriting process by 2-3x, enabling them to process more applicants. More importantly, they have greater visibility into credit quality on an ongoing basis.